CyberSource Payments processes debit, credit and closed-loop gift cards across the globe and across multiple channels with unparalleled scalability and security. CyberSource supports an extensive list of payment cards and recurring billing options across a wide choice of gateways and acquiring banks, all through one connection. Using CyberSource solutions, merchants can accept payments (cards, digital payment services, alternative payments) in over 190 countries, funds in more than 20 currencies and protect customers from fraud loss by capitalising on the world’s largest fraud detection radar. Payment security and tokenisation solutions enable payment acceptance via the web, mobile and call centre/IVR without toxic payment data touching your network or being stored in your environment.

Payment Methods

Utilize these APIs to develop secure ways for customers to pay online, seamlessly transfer funds or even use virtual currency.

CyberSource Payments

Available APIs

CyberSource Payment API

Currently, the CyberSource Payments API provides functionality for payment processing and transaction search for authorisations, captures, sales, voids, refunds and credits of e-commerce transactions.

Visa Direct

Enable sending money in real-time1 to all eligible US debit or prepaid cards. With the rise of mobile and shared services, consumers and businesses expect faster, more convenient ways to pay. Visa Direct is a solution that helps financial institutions enable businesses to create fast, convenient, and secure digital payment experiences using the cards consumers already have in their wallet. Visa Direct can be used to empower person-to-person (P2P) payments and for government, corporate or merchant funds disbursements for tax refunds, insurance claims reimbursements, rebates, or affiliate/contractor/shared economy provider payouts.

For businesses, Visa Direct can help reduce the costs of using cheques and streamline operations, while providing customers with innovative and brand differentiating payment experiences. There are multiple funds disbursement programmes and person-to-person payment providers that are live today, and many more are in development. Through financial institutions, Visa Direct enables payment service providers to:

- Enhance the consumer experience by eliminating the need to provide sensitive identifying information

- Provide a fast and secure way to send and receive payments backed by Visa’s proven, reliable and trusted payment network

- Participate in a digital payments platform that provides speed, simplicity, security and scale. With fast funds processing, payouts are made and funds can be available in real-time1 with approved authorisation2

Available APIs

Funds Transfer API

Pulls funds from sender’s debit card and pushes payment to recipient’s debit card.

Payment Account Attributes Inquiry

Find key attributes of a specific payment account

Payment Account Validation

Access multiple methods of ensuring that a payment account is valid

Reports

Provides reporting capabilities such as transaction reconciliation data API. The data needed for reconciliation includes transaction details and any exceptions such as chargebacks & reversals. This data allows you to reconcile the transactions sent by your systems with what was processed through VisaNet.

Learn more at the Visa Developer Centre

1. Actual fund availability varies by financial institution. Visa requires US issuers to make funds available to its cardholders within a maximum of 30 minutes of approving the transaction.

2. Issuer participation may vary (99% of Visa Debit accounts in the US are enabled as reported by issuers).

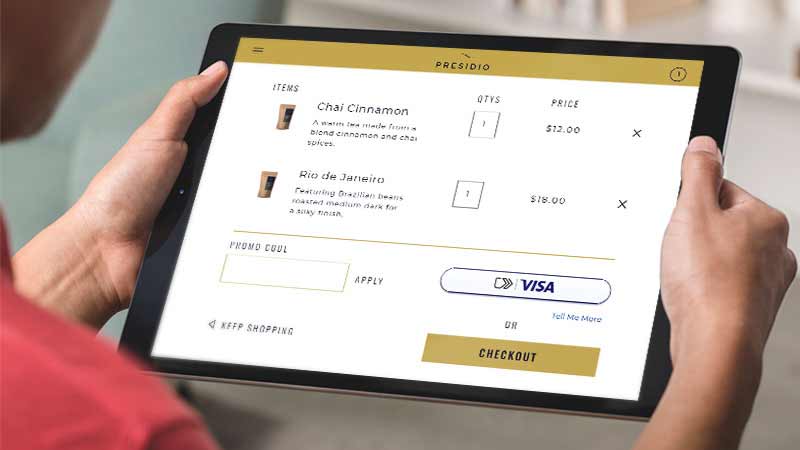

Click to pay with Visa

Click to pay is Visa’s implementation of EMVCo’s newly-published industry-wide standards and specifications that will create a fast, frictionless shopping experience.

Online shopping. Simplified

Easy

Enrolled customers no longer have to enter account numbers, look up passwords or fill out long forms to make a purchase.

Smart

Fast, simple digital checkouts reduce friction, which can help to lower basket abandonment and increase conversions.

Secure

Visa uses multiple layers of payment security to protect sensitive customer and transaction information. With Visa, your customers can buy with confidence.

The EMV® SRC payment icon, is a trademark owned by and used with permission of EMVCo, LLC.

EMV® is a registered trademark in the USA and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC.

Visa Secure Remote Commerce. Built to handle eCommerce's biggest challenges

Online shopping isn’t frictionless. And that’s why adding an evolved guest checkout experience is so important.

gap between present and card not present authorization rates.1

annual eCommerce fraud growth rate through 2023.2

of mobile eCommerce carts are abandoned. On desktop, it’s 73%.3

Sources:

- 1. September 2019 VisaNet Global Data

- 2. eCommerce Fraud Trends 2019, Merchant Fraud Journal, https://www.merchantfraudjournal.com/ecommerce-fraud-trends-2019/

- 3. Forbes, Why Cart Abandonment Rates Aren’t Falling, 2018, https://www.forbes.com/sites/paultalbot/2018/06/27/why-cart-abandonment-rates-arent-falling/#7f1bfd7f7bb6

The EMV® SRC payment icon, is a trademark owned by and used with permission of EMVCo, LLC.

EMV® is a registered trademark in the USA and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC.